Globalized business

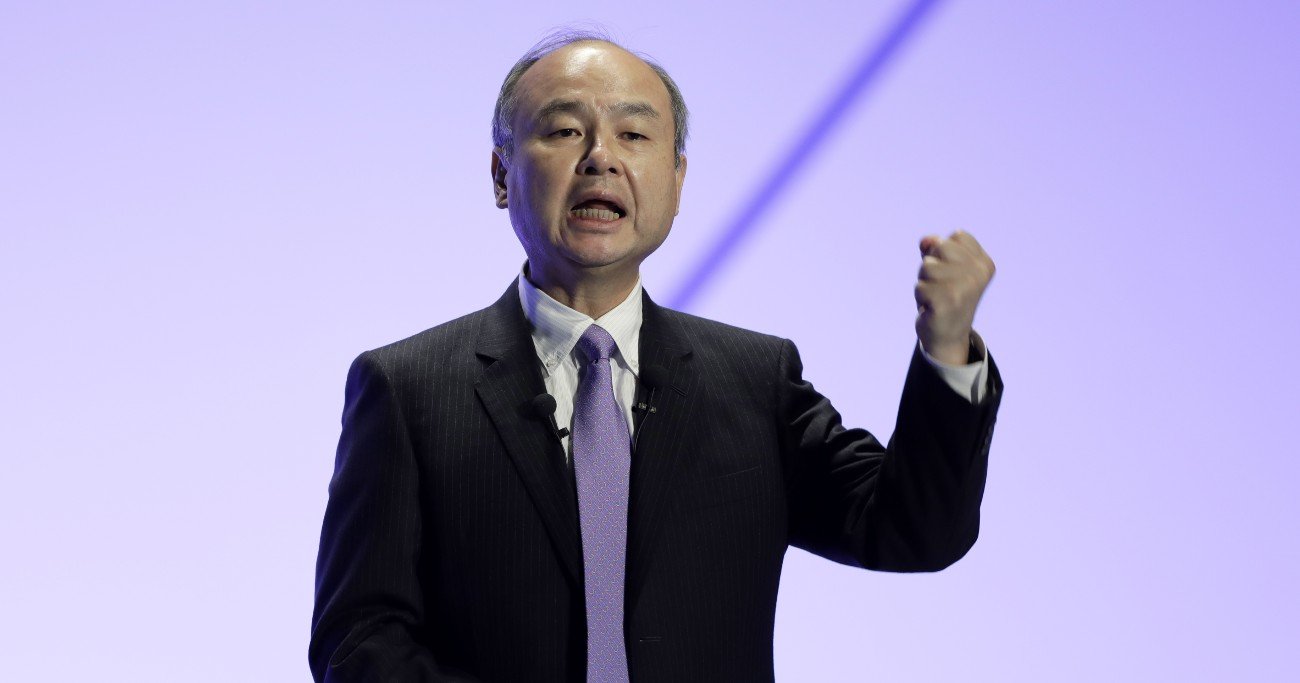

SoftBank’s business is based on three elements.

The first is high leverage. A small private fund is the core that draws in more external funds, leading to huge investment amounts. The second is high risk, high returns. SoftBank’s investment portfolio is thought to consist mostly of high-tech, high-growth companies. The companies have high beta and are sensitive to market fluctuations. The final element is Son’s discerning eye. His insight into the potential of Alibaba and Yahoo transformed SoftBank from a run-of-the-mill software distributor into one of the world’s leading investment companies.

These three gears fit together to drive SoftBank’s remarkable growth. Combined with Son’s charismatic personality, SoftBank has spun a tale of investment adventure that has enraptured people around the world.

But SoftBank’s story was built on a specific stage: global economic trends.

Certain characteristics of the global economy from the 1990s until very recently stand out. Most notable are disinflation, low interest rates and high stock prices, all in response to globalization.

The fall of the Berlin Wall in 1989 marked the end of the Cold War bloc economy, and countries such as Russia and China entered the international economic system. The era of the global economy had arrived.

The barriers imposed by national borders are lowered in the global economy, and people, goods and money move relatively freely among countries. Inflation is unlikely to occur even if demand rises, because supply and demand can be balanced by increasing supply capacity though investment in countries with cheaper labor to meet the higher demand. Less inflation means interest rates are less likely to rise, and lower interest rates typically result in higher stock prices. This combination of disinflation, low interest rates and high stock prices fueled SoftBank’s business model.

But now that set is being taken apart.

‘One world’ undone

The concept of deglobalization has thus far been most discussed in international relations, and its impact has not been sufficiently deliberated in the field of economics. However, I believe that deglobalization will determine the course of the global economy for the foreseeable future, largely reversing the economic mechanisms of the roughly past two decades.

The U.S.-China conflict, which has been continuing since the late 2010s, and Russia's invasion of Ukraine in February of this year were decisive factors in fracturing global supply chains. The U.S.-China conflict, essentially a struggle for hegemony, is unlikely to be resolved within in the next five to 10 years. There are no indications that peace will prevail in Ukraine. Borders are once again becoming a formidable presence in the distribution of energy, food and advanced industrial products like semiconductors, and the “one world” is beginning to disappear.

When supply chains are fragmented, even a small increase in demand can easily lead to inflation. To temper inflation, central banks have no choice but to raise interest rates. Rising interest rates will pour cold water on stock prices. Deglobalization and its accompanying inflation, rising interest rates and lower stock prices marks a major turning point for SoftBank’s business.

Changing tack

Son is well aware that the environment has changed dramatically and that he must act accordingly.

Objectively there are several options. SoftBank could reduce its leverage. Taking this argument to the extreme, this would be done within the scope of Son’s and SoftBank’s own funds. However, this option leads to a balanced contraction. Son would not be able to continue his style of buying promising high-tech companies around the world. Moreover, now that the Vision Fund has become massive and includes many external funds, it would likely be difficult for Son to make major changes to its structure at his sole discretion.

The company could stop its high risk, high return approach. One investor to compare with Son in this regard is Warren Buffett. Buffett's main strategy is to buy value stocks with low beta, such as Coca-Cola and Johnson & Johnson, when they are cheap. Low beta stocks with low market sensitivity perform well in a bear market. Buffett-style investments look quite compelling in the current conditions.

But low-beta value stock investments are unlikely to appeal to Son, considering his personality. His raison d'etre is to pursue high risk, high returns, and to stop doing so would be tantamount to self-denial.

Finally, there is Son’s discernment. Son has focused on buying high-tech companies that show tremendous long-term growth. Even if interest rates rise or fall, or the economy improves or worsens, the companies’ value grows based on the long-term trend line throughout these changes. As with Yahoo and Alibaba, it is buying a goose that lays golden eggs, which will multiply hundreds or thousands of times over the long-term. After all, Son says he is investing for the next 300 years.

But a problem arises if the profitability or losses of an investment are evaluated over a period of one year. Son and his Vision Fund may indeed be investing in companies that will succeed in the long run. However, as long as it is structured as a fund that relies on external funding, investors will be watching its annual results closely. Regarding SoftBank’s management, typical banks and other financial institutions evaluate the profitability and soundness of companies every fiscal year. Because of the changes in global trends, management that employs leverage and Son’s talent for discernment no longer mesh as well as they did previously.

The next 20 years will look very different from the previous 20 as global economic trends change. Son’s coming decisions will be major topics of interest and study.

Akio Makabe is an economist and a specially invited professor at Tama University. After graduating from the Faculty of Commerce at Hitotsubashi University, he joined Dai-Ichi Kangyo Bank (now Mizuho Bank). After graduating from the London School of Management Education, he was transferred to Merrill Lynch's New York headquarters. After becoming a professor at Hosei University Graduate School, he assumed his current position in April 2022.