Originally published in Japanese on August. 16, 2023

Emerging trends

Since COVID-19 came to be treated like seasonal flu, "Experience in Japan" has become very popular. Even though I have lived in Japan for over 20 years, I still discover new things here every day from the food, shopping, culture, history, and contact with nature. The country must be a constant surprise to those who come to Japan on vacation.

In particular, the more affluent and highly educated people in Europe and the U.S. tend to seek unique experiences in Japan. This is in part due to the fact that they feel that they are getting a good deal from the weak yen, but also because of the creative nature of the Japanese people.

In addition to "Experience in Japan," another recent trend that is gaining attention overseas is "Used in Japan." The value of used products from Japan has been increasing in overseas markets due to the Japanese trait of caring for things and their love of cleanliness. At PayPal, where I am the head of Japan operations, we are also seeing the rise of "Used in Japan."

As a concrete example, let me introduce BE FORWARD, a used-car cross-border e-commerce company headquartered in Tokyo. The company was established in 2004, and it has been growing rapidly by exporting used Japanese cars to emerging countries. Its sales for the fiscal year ending June 2022 were 81.4 billion yen ($546.6 million at the current exchange rate), and it exported 133,370 used vehicles.

According to BE FORWARD's sales volume by area for the past year, Africa accounts for about 60% of its sales, and the Caribbean region for about 15%. The company is also focusing on the U.S. market. In the U.S., Japanese sports cars and mini cars are currently popular.

Before I explain why, let’s first take a quick quiz: What are the top three Japanese used cars sold by BE FORWARD in the U.S. market?

The used (in Japan) car market

According to BE FORWARD, as of the end of June 2023, Mitsubishi Motors' Pajero Mini is number 1, Honda's Acty Truck is number 2, and Daihatsu Motor's HIJET Truck is number 3.

Website of the Japanese used car cross-border e-commerce company BE FORWARD

Website of the Japanese used car cross-border e-commerce company BE FORWARD

In the U.S. state of Colorado, where I was born and raised, automobiles are a necessity of life. During my school years, there was a huge boom in Japanese cars. Japanese cars were fuel-efficient and rarely broke down. My father was a thrifty man, and in our family, we always had used cars. And he drove many Japanese cars, one after another, so I completely understand why Japanese used cars are now selling well in the U.S.

The Japanese cars that my family used to buy were used vehicles that were distributed in the U.S., but the cars handled by BE FORWARD include some that were manufactured and sold in Japan. In the U.S., there is a law that prevents the import and sale of vehicles that were manufactured and sold overseas unless 25 years have passed since the year of manufacture. This so-called "25-year rule" is a regulation that prevents imports from other markets.

Japanese used cars have three major characteristics: strict vehicle inspections, fast replacement cycles, and low mileage. In addition to this, new brand values such as the "Used in Japan" image, which suggests that Japanese people must have used the products neatly and cared for them, have added to the popularity. This is why Japanese used cars have high market value even if they are more than 25 years old.

In Europe and the U.S., awareness of global warming and the movement to reduce waste are growing stronger by the day. This has also influenced a shift in values away from mass-consumption societies and toward societies that appreciate using things carefully for longer periods of time. In this global trend, "Used in Japan" itself is becoming a widely praised new value. Of course, consumers are also very demanding in terms of quality and price. But interestingly, they no longer focus only on who made a product and where it was made. They now also consider “who has used it.”

Furthermore, the reputation in the secondary and tertiary markets brings a virtuous circle that leads to a good reputation in the primary market. In this sense, the ripple effect of focusing on "Used in Japan" is significant.

In addition, BE FORWARD introduced PayPal's Pay Later service when it entered the U.S. market. This allows buyers to pay the total cost in installments, making it easier for them to purchase even expensive products such as cars. Even for items with high unit prices, a means of settlement is now in place that allows for secure global transactions.

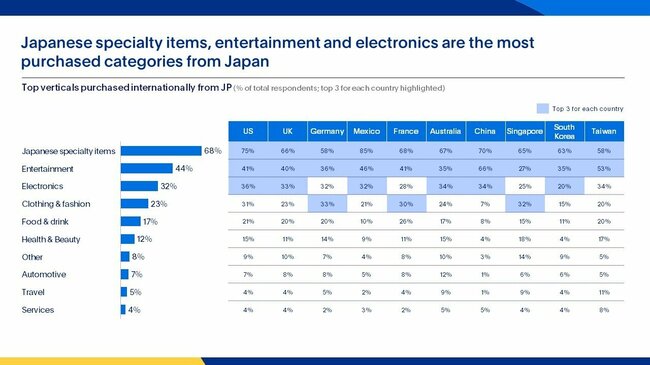

Now, here is the second quiz question: In a survey of PayPal users, what are the top three product categories that global consumers purchase from Japan?

Appetite for risk

Let's quickly answer that question. In a survey of PayPal users, the top three product categories purchased from Japan by global consumers (multiple responses allowed) were "Japan-specific products (anime-related and others)," followed by "entertainment" and "electronics". Automobiles also made the Top 10 list.

Japanese used cars are evolving and deepening their brand value through "Japanese specifications" and "Used in Japan." In this age of cross-border e-commerce, it is possible to deliver both physical and digital goods around the world very quickly and easily. New business opportunities are cropping up.

Especially in the past decade (despite the challenges of the COVID era), the hurdles to cross-border e-commerce have been greatly lowered. A decade ago, there were various challenges, such as securing logistics bases, complicated customs clearance procedures, language barriers, and e-commerce tool development, but almost all of these issues have been resolved.

Overseas marketing, one of the remaining major challenges, can also be overcome by utilizing various services that support cross-border e-commerce. At any rate, it is important to get started. Once a company gets started, it will quickly learn and collect data regarding what sells and what does not. From there, it can repeat the process with continually improving data and insights.

The only challenge for Japanese businesses is to embrace a mindset of "taking on challenges and risks."

I have dealt with many managers and entrepreneurs, and there are, of course, many talented people in Japan who have a sense of "going for what they want to do no matter what." But there remains a cultural bias to take a conservative approach and minimize risk. In the U.S., it is more common to encounter a mindset of "even if I fail, I will get it right next time or the time after that. " People do not fear failure, and in fact, many people enjoy such difficulties.

In Japan, on the other hand, there is a tendency to dislike failure. This is probably due to a sense of seeking to avoid troubling others through your own failures. As mentioned at the beginning of this article, Japan has many attractions that surprise and delight people around the world. Therefore, Japanese companies should be willing to take bigger chances on overseas markets. The risks are much lower than one might think!

In this context, BE FORWARD, which is aggressively using cutting-edge services and technology, seems to be enjoying the benefits of the Japanese brand to the fullest: "Made in Japan," "Experience in Japan," and "Used in Japan."

In a manner of speaking, it is the first penguin to jump into the sea to get the fish. I am sure that second and third penguins will soon follow.

Peter Kenevan is the VP and Head of PayPal Japan. He has more than 25 years of work experience at McKinsey & Company, a leading consulting firm, and has been a senior partner in the Tokyo office for many years. The views expressed here are his own.