Originally published in Japanese on December 26, 2024

Be wary of “Trump Shock”

DIAMOND: The year-end issue of our print magazine, Diamond Weekly, contains a special feature called “Forecast 2025.” Could you please share your outlook for the U.S. economy in 2025 under the Trump administration, along with your assessment of the Federal Reserve's monetary policy?

SUMMERS: The good news about the U.S. economy is that there does not appear to be anything currently in train pointing to a downturn. I expect reasonably robust economic growth, with stable unemployment, to persist for the foreseeable future. Though, of course, shocks could occur. I am more concerned about inflation. Both because I suspect underlying inflation may be a bit greater than the consensus supposes, and because I'm concerned about Trump shocks that raise inflation, particularly tariffs and restrictions on labor supply (from immigration). My instinct is that given the strength of the economy and given the potential inflation shocks, there may be somewhat less room for rate cutting than the market now supposes.

DIAMOND: The U.S. stock market, which is at an all-time high, has been boosted by the AI boom, and some believe it’s a bubble led by a few big tech companies, such as Nvidia. Bitcoin has also surged to an all-time high. What do you think about these conditions?

SUMMERS: Every investor will have to make their own judgment. There's no question that there is substantial optimism around the AI sector and those like Nvidia, who provide inputs to the AI sector. People first started expressing concerns about a tech bubble in the United States in 1996. That's when Alan Greenspan used the phrase “irrational exuberance.” The market more than doubled in the succeeding four years. Ultimately, concerns about a bubble that were expressed in the year 2000 proved to be prescient. Where we are on a continuum between a market response to positive fundamental developments, along with growing optimism, and an overvalued bubble-type market, is a judgment every investor will have to make for him or herself.

I suppose it’s not surprising that news of public policy becoming more favorable and less regulatory towards crypto is associated with a sharp increase in crypto prices. How long this will last is, I think, very difficult to judge.

DIAMOND: There are a variety of potential risks, such as a resurgence of high inflation, a financial crisis, a Taiwan contingency, and so on. What could be the most severe factor for the global and U.S. economies in 2025 and beyond?

SUMMERS: I suspect the policy choices that the Trump Administration makes are probably the single most important factor for the years ahead. If those choices focus on removing unnecessary regulations and barriers to investment, and creating a strong enabling environment for technology, the outcome can be quite positive. If policy measures are taken that break down the integration of the global economy and undermine the predictability that comes from the rule of law, the consequences for financial markets could be quite adverse. I think this is something that investors will need to monitor very closely in the months ahead.

DIAMOND: Many experts note that the Chinese economy is struggling. Trump intends to impose a 60% or higher tariff on imports from China. How do you think this could affect its economy, which is already showing signs of slowing down?

SUMMERS: Potentially, the proposed tariffs could have adverse effects on China that exceed any effects that they have on the U.S. economy, particularly if production is relocated out of China to Vietnam and other potential providers of lower-cost labor. The Chinese face profound challenges of savings absorption that they will need to work through in the months ahead.

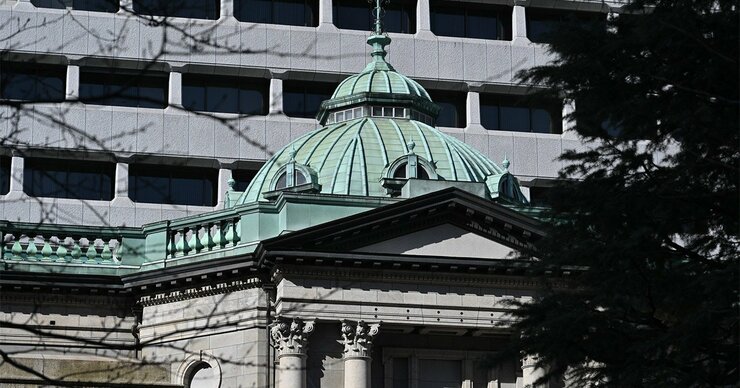

DIAMOND: What is your assessment of the Bank of Japan (BOJ) monetary policy since Kazuo Ueda took office as governor in April 2023? Also, what do you think is the biggest problem facing the Japanese economy?

SUMMERS: Japan has taken substantial positive steps in recent years. I think Japan still faces two critical problems. It faces a problem of overcoming deflation, and it faces a problem of entrepreneurial energy, drive and identifying major structural sources of growth. I don't think monetary stimulus can really be a substitute for fundamental economic energy. I think Governor Ueda has done an appropriate job so far, although I don't feel close enough to the situation to comment on the particular tactical steps that have been taken. The biggest challenge for Japan is to find some kind of structural energy that is large enough to propel growth and generate investment, given the headwind of a shrinking labor force.

LAWRENCE H. SUMMERS is Charles W. Eliot University Professor and President Emeritus at Harvard University. He served as the 71st secretary of the treasury for President Bill Clinton and the director of the National Economic Council for President Barack Obama.