Originally published in Japanese on June 9, 2024

Finding the right inflation

Japan’s inflation is trending downward, mainly reflecting a decline in food inflation (excluding volatile fresh food prices), even though food inflation still accounts for half of the latest April inflation (2.5%). Meanwhile, energy inflationary pressures are gaining. Rising gasoline prices and the scheduled phase-out of subsidies for electricity bills in May, along with their end from June, will raise inflation for a while.

However, energy factors are unlikely to stop overall inflation from dropping below 2% in 2025 once the impacts of those temporary factors and yen’s depreciation dissipate. To ensure inflation at around 2% is durable, the BOJ has stressed the fact that the inflation structure will change over time, since the secondary force of inflationary pressures will eventually overtake the first. The first force of inflation, which arises from cost-push factors, is transitory by nature and dominates current inflation. The BOJ anticipates the second force, which is driven by the virtuous wage-price cycle based on domestic demand and economic improvement, will gain over time and overtake the first force, thus enabling inflation to sustainably remain at around 2%.

This is the BOJ’s favored inflationary outcome, but for it to happen, three factors need to show further improvement. First, the BOJ’s presentation materials posted on May 21st―which will be the basis for the upcoming 25-year review of unconventional monetary policy tools―indicate that the composite medium- to long-term inflation expectation indicator (looking 10 years ahead) has risen since 2022 and reached 1.5%.

They also showed that the impact of inflation expectations on actual inflation has risen and currently accounts for nearly half of actual inflation. These are positive developments in assessing the durability of inflation at around 2%. However, the inflation expectation indicator remains well below 2%, and it is not yet anchored at 2%. As inflation expectations have risen since 2022 when commodity prices and yen depreciation began simultaneously, higher inflation expectations may simply reflect higher costs and import prices, as well as the sense of rising imported material costs among companies that have not yet been able to sufficiently pass those cost on their sales prices.

Second, wage growth (year-on-year) was 1.5% on average for the January-April quarter this year, while real wages dropped by 1.4% for the same quarter. Wage performance improved substantially to 2.1% (-0.7% in real terms) in April reflecting successful spring wage negotiation results of 5.6%—the highest since the 1990s. Last year’s successful wage negotiations resulted in a 3.6% settlement, but actual wage growth, including small- and medium-sized enterprises (SMEs) was disappointingly low at 1.2% (-2.5% in real terms).

This year’s actual wage growth will be higher thanks to more successful wage negotiations and a greater willingness to raise wages among SMEs. Positive wage growth is likely to be sustained, reflecting severe labor shortages driven by the mass retirement of elderly workers of the baby boomer generation and tighter regulations on overtime hours. Various surveys show that companies no longer try to exert downward pressure on wages when costs rise due to the need to maintain current employees and attract new workers.

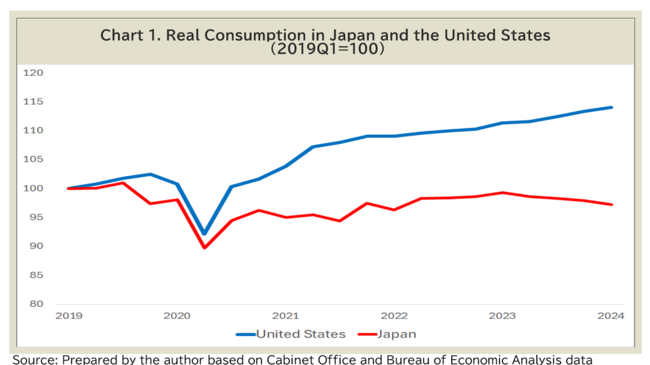

Indeed, some companies have begun to pass increased production costs and wage increases on to sales prices. At the same time, however, various surveys reveal that many SMEs find it extremely difficult to pass those increased production and wage costs on to sales prices due to weak domestic consumption (see Chart 1). Those aged 65 or older account for nearly 30% of the population. This generation tends to have a weaker consumption appetite due to longevity risks, growing medical spending, and pension-based income. Thus, the central bank needs to check whether wage growth driven by demand and economic growth will emerge and stay at a rate consistent with the 2% price stability target.

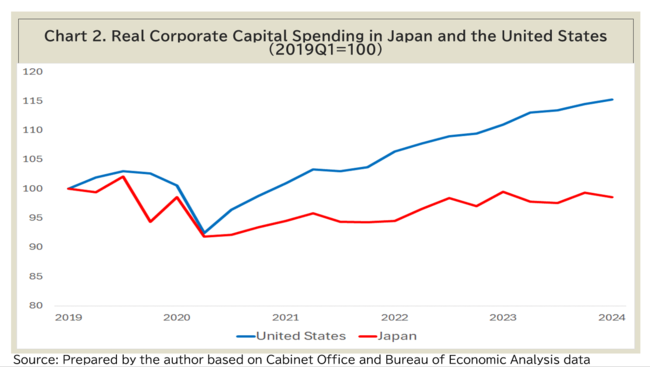

Third, and most importantly, Japan’s labor productivity growth, both on an hourly and a per-employee basis, remains sluggish, recording around 1% and 0%, respectively. Raising real wages without labor productivity growth is unlikely to be sustainable. With higher wage payments, the company might find it inevitable to reduce profits or request price reductions from suppliers, according to various surveys. These responses have not changed much, even in more recent surveys. Sluggish labor productivity reflects long-standing sluggish corporate capital spending (see Chart 2). Expectations for changes in Japan’s corporate behavior are emerging among foreign investors since the Financial Services Agency and Tokyo Stock Exchange urged companies with low price-to-book-value ratios to improve performance and attract shareholders. Companies have been increasing shareholders’ returns, but proactive, forward-looking investment behavior has not materialized as a whole.

Therefore, at this stage, it is unclear whether the BOJ’s preferred wage-price spiral based on domestic demand growth and economic improvement will happen. Considering these factors, raising interest rates may not be consistent with the BOJ’s goal of stably achieving 2% inflation.

BOJ’s options

In the face of excessive yen depreciation, the government and the BOJ appear determined to make concerted efforts to prevent a resurgence of intense depreciation pressures leading to 160 yen per U.S. dollar. For this reason, the BOJ lowered its monthly purchases of 10-year Japanese government bonds (JGBs) in the middle of May. The BOJ generally announces the quarterly scheduled purchase plans at the end of the preceding month (namely, around the end of June for July-September 2024).

Markets expect the BOJ will announce a plan to reduce monthly JGB purchases for the July-September period at its June Meeting. The BOJ is likely to provide the following rationales for further normalization: (1) the improved wage developments from April, (2) higher long-term inflation expectations, and (3) some positive corporate behavior to pass wage and cost rises to sales prices. These expectations have already increased JGB yields to around 1%. The decision to raise the policy rate (from 0-0.1%) and the associated increase in the interest rate on excess reserves might be postponed until later this year. Such a move would raise costs for the BOJ by increasing interest rate payments to banks, thus impacting the BOJ’s profits.

To summarize, the weak economy and domestic demand do not justify further rate hikes. But if the BOJ wishes to correct excessive yen depreciation by normalizing monetary policy as much as possible, the BOJ is likely to promote further upward pressure on the 10-year yield and later hike the policy rate. At the same time, a correction of the yen toward appreciation may lower inflation and inflation expectations. Wage pressures arising from labor shortages may not be strong enough to stably maintain 2% inflation due to weak consumption demand.

Sayuri Shirai is a professor at the Faculty of Policy Management, Keio University, and a former Bank of Japan board member (2011-2016). She holds a Ph.D. in economics from Columbia University. The views expressed here are her own.