Originally published in Japanese on Apr. 18, 2022

TSE Reforms

In April, the Tokyo Stock Exchange (TSE) underwent a major restructuring. The number of categories at the exchange was slimmed to three from five, and new rules were put in place for its flagship Tokyo Stock Price Index (TOPIX). Some hoped that the changes would weed out non-performing companies and lift stock prices, but more will be needed to fix corporate governance at Japanese companies and boost their lackluster growth.

Stock markets and shareholders play important roles in reforming corporate governance, so the changes at the TSE attracted a great deal of investor and media attention. Some observers, however, have criticized the restructuring as ineffective.

There were two main elements to the TSE’s restructuring. First, the exchange aimed to streamline its categorizations. The former five sections of the TSE, the First, Second, Mothers, JASDAQ Standard and JASDAQ Growth, were reorganized into three categories: Prime, Standard, and Growth.

The Prime Market is composed of companies with large market capitalizations and liquidity, as well as high levels of corporate governance. Among the 2,176 companies that belonged to the First Section of the TSE as of the end of March, 1,839, or 85%, moved to the Prime Market. The Standard Market had 1,467 companies, and the Growth Market had 466 companies as of April 7. Listing and delisting criteria, such as the tradable market capitalization, will become more stringent for companies that new list going forward.

The second part of the restructuring is revisions to the rules applied to the constituents of the TOPIX. The index contained 2,176 constituents as of the end of March 2022. That is quite large for a stock index, and many are small stocks with lower liquidity. Some have noted that TOPIX is inadequate as a benchmark for index funds.

The new TOPIX rules mean that constituents will be selected mainly from the Prime Market and basically be those with a tradable market capitalization of 10 billion yen ($77 million) or more. Although the existing TOPIX constituents as of April 1, 2022, will remain in place regardless of their market categorization, companies that do not meet the criteria will gradually be removed until 2025. However, because the total market capitalization of constituents that will be removed over this period is relatively small, the index will not become significantly more or less volatile.

Many critics of the restructuring have said that there are too many companies in the Prime Market and their quality varies widely. The listing criteria should be made more stringent to drive failing companies out of the market, they argue. However, reducing the number of listed companies will not lead to greater growth potential among Japanese businesses, which would in turn drive up stock prices and lift the TOPIX.

In the past, the index did not change significantly, even when its constituents changed. As of March 31, 2022, the index rate of increase over the past ten years is 127.8% for TOPIX (2,176 constituents), almost identical to that of TOPIX 100 (100 constituents) at 127.1%. The rate of increase of the TOPIX Core30, which limits the number of constituents to 30, is relatively low at 116.9%

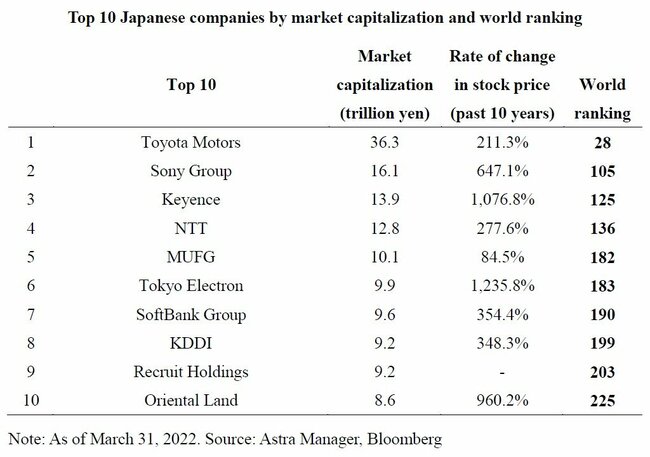

Additionally, the Prime Market will inevitably have some lower quality companies, even if the number of constituents is reduced, as the number of companies considered “good” according to international standards is limited in Japan. Looking at the top companies worldwide in terms of market capitalization, only one, Toyota Motors, is Japanese (compared to 63 U.S. companies and 11 Chinese companies). Even Sony Group, the second-largest company in Japan, ranks only 105th on this list. Even reducing the number of companies listed on the Prime Market to 300 from 2,176 would likely do little to boost the index’s growth.

Critics have also noted that even after 2025, the TOPIX will still contain about 1,500 constituents, many of which will be lower-liquidity stocks and stocks with small market capitalizations. However, this criticism also misses the point of the index.

The TOPIX exists to show the trend of the entire stock market, and it is not designed to be a benchmark for index funds. A different index that includes only large stocks, such as MSCI Japan or TOPIX100, would better serve that role.

Limited reforms

Looking at the history of capital markets and corporate governance reform in Japan, there are many instances of government intervention. The recent TSE restructuring is another such occasion.

However, there are limits to government-led governance reform. It has been seven years since the introduction of the Japanese government’s Corporate Governance Code (CG code). Stock price growth has been much greater in the U.S. than in Japan during that time. As of the end of March 2022, stock prices had grown 119.1% in the U.S. (the S&P 500) compared to 26.1% in Japan (TOPIX).

There is also a wide gap between the two in return on equity, forecast by Bloomberg for the current fiscal year to be 22.6% in the U.S. and 9.3% in Japan. There has also been a series of major scandals among leading electronics manufacturers, megabanks, and major securities companies, pointing to a serious deterioration of corporate governance in Japan. Incidentally, the U.S. does not have an official CG code.

In the U.S., private companies operate exchanges and stock price indices, and the government rarely intervenes other than for regulatory reasons.

Some of the major reasons behind the weak growth of Japanese companies may, among others, be: (i) lagging digital transformation; (ii) insufficient development of venture companies and the continued existence of many old companies; (iii) the continued culture of seniority-based promotion and lifelong employment and the resulting low liquidity in the labor market. These are structural reasons, and it seems unlikely that they can be fundamentally addressed with tactics like simply changing the listing criteria of an exchange or stock price index.

To increase the growth potential of Japanese companies and strengthen their governance, it is necessary to make maximum use of the dynamism of the private sector, as in the case of the U.S. Good governance cannot be realized through simple formalities, like appointing external directors. It can only come from a competent CEO. Developing venture companies is a good way to cultivate talented CEOs, and structural reforms to develop world-class venture companies and increase the “good” companies under international standards will be important steps in the true restructuring of the TSE.

Tsutomu Fujita is a visiting professor at the School of Business Administration, Hitotsubashi University Business School, and the representative of the Hitotsubashi University Graduate School Fintech Research Forum. The views expressed here are his own.