Originally published in Japanese on Jul. 20, 2022

Big expectations

In May, IBM revealed its new roadmap to creating a quantum computer of at least 4,000 quantum bits (qubits) by 2025.

What are IBM’s expectations for Japan?

Koichi Semba, project professor at the Graduate School of Science in the University of Tokyo, had the chance to ask Vice President Jay Gambetta, who heads the quantum computing sector at IBM, this question when he attended the meeting for IBM partners in Zurich, Switzerland.

Gambetta’s answer came down to one word: “components.”

IBM opened a quantum computer testing facility on the Asano Campus of the University of Tokyo in June 2021. The goal is to further improve machine performance by taking advantage of Japan’s competitive component industry. The facility allows IBM to swap out its own quantum components, which are generally kept confidential, with those made by other companies to test differences in performance.

Several Japanese manufacturing companies signed contracts with IBM and the University of Tokyo and began using the facility this spring, said Semba, and several others are considering joining the project.

Quantum computing is expected to impact every sector of the economy. As the technology develops, components for quantum computers are also expected to grow into a massive industry. According to a forecast by the Boston Consulting Group (BCG), the hardware for quantum computers will become a 2- to 4-trillion-yen a year market globally between 2030 and 2039.

“Talking with the executives of Japanese companies, we find that while they have a feeling that quantum computing will grow into an important industry, there are still few who are firmly committed to making it a business,” said Semba. “Many say that they would definitely like to try and test whether their companies’ technologies are useful or not. We’re hoping to create a success story for components made in Japan using the test facility in Asano.”

The Tokyo University facility is not unique. There is also a test facility for quantum computers at Osaka University. Associate Professor Makoto Negoro of the Osaka University Center for Quantum Information and Quantum Biology, who was central in building the test site, emphasized that a quantum computer could be manufactured with components "almost entirely made in Japan."

Homegrown ambition

Two quantum computers are being developed in Building J of the Graduate School of Engineering Science on the Toyonaka Campus, Osaka University. A research team here aims to develop a quantum computer “almost entirely made in Japan” using qubits from the team led by Yasunobu Nakamura, Director of the RIKEN Center for Quantum Computing while finding the remaining equipment on its own.

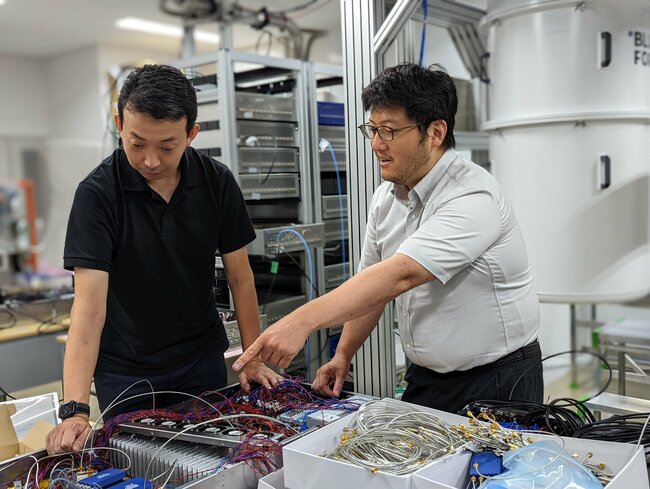

Associate Professor Makoto Negoro, center, is working to develop a quantum computer “almost entirely made in Japan” at the test facility at Osaka University. Left is CEO Yosuke Ito of QuEL, Inc., a quantum venture established at Osaka University. Photo by H.O.

Associate Professor Makoto Negoro, center, is working to develop a quantum computer “almost entirely made in Japan” at the test facility at Osaka University. Left is CEO Yosuke Ito of QuEL, Inc., a quantum venture established at Osaka University. Photo by H.O.

“When you encounter trouble, you can’t tell whether you should improve the software or if there is a problem with the hardware just by using a quantum computer via the cloud,” said Negoro. “It’s also necessary to focus on ‘made in Japan’ to prevent our country from losing the capability to manufacture a quantum computer.”

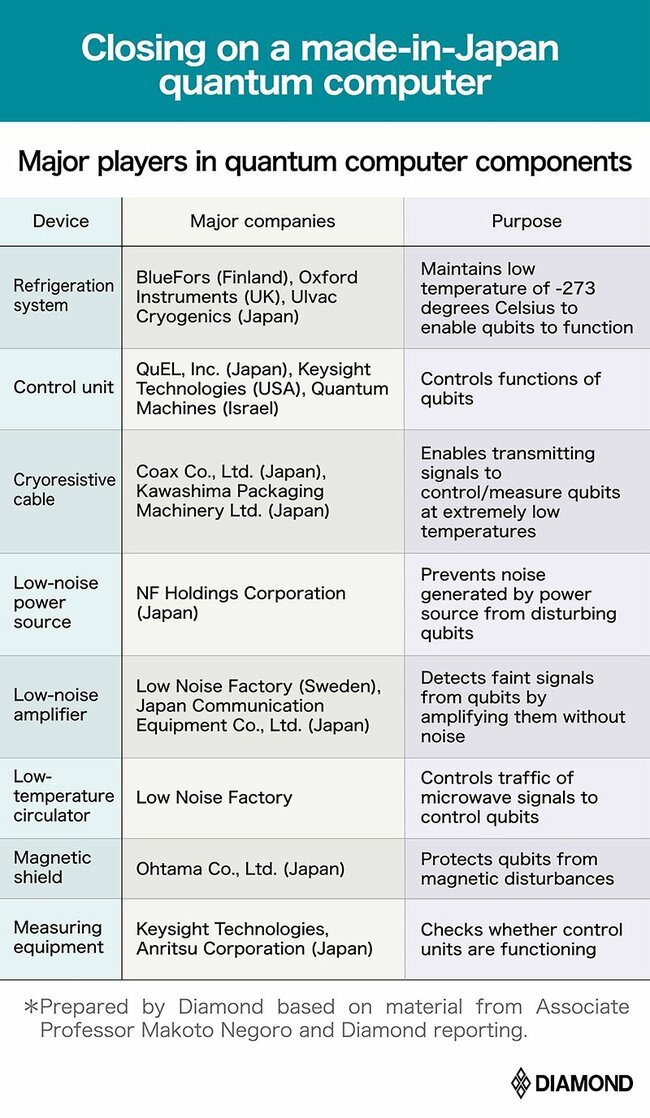

In his quest to build a homegrown quantum computer, Negoro has collected extensive information about prominent Japanese companies in the quantum computer component business.

Superconducting qubits need to operate at an extremely low temperature of about -273 degrees Celsius. Coax, a company in Yokohama is making its presence felt in the field of cryoresistive cables, which ensures communication signals function properly even in this extreme environment. The company’s products are used in major quantum computers like those of IBM, which is said to have a worldwide virtual monopoly on the market.

QuEL, Inc., a quantum venture established at Osaka University, provides control units for quantum computers. Their products stand out for their small size and ability to control multiple qubits with only one unit. “An experiment to control 64 quantum bits with 12 units is currently being conducted,” said Negoro. “Even a control unit for a 1,000-quantum-bit computer could be housed within a space of 16 cubic meters.”

The components industry is set to grow in the future as the performance of quantum computers improves. Japanese companies stand to benefit if they can keep their competitive edge.

500-million-yen price tag

“You need 1 trillion yen to make a million-bit quantum computer.”

This remark by Shintaro Sato, director of the Quantum Studies Laboratory of Fujitsu Laboratories, during a May 2022 briefing on Fujitsu’s quantum computing drew the industry’s attention. However, many industry participants note that the assumption of 1 million yen per 1 qubit is “fairly bullish at present.”

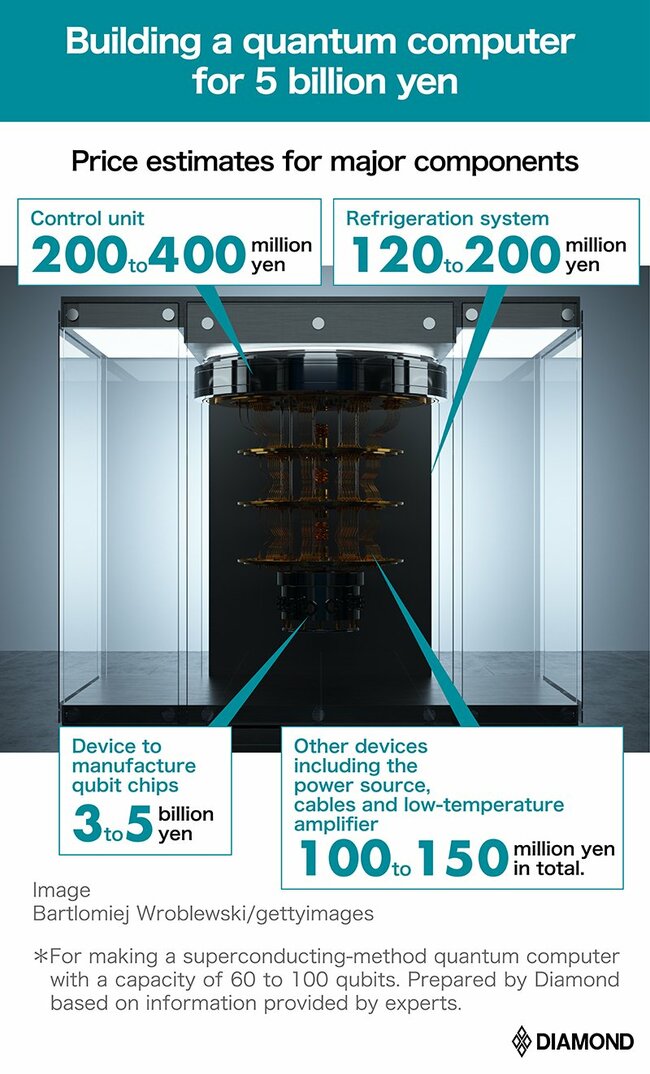

How much will it actually take to manufacture the components for a quantum computer? Diamond developed an estimate based on information from several experts.

Manufacturing a 60- to 100-qubit computer using the mainstream superconducting method means the quantum bit chips, the heart of a quantum computer, are the most expensive device to manufacture. They employ technology used in semiconductor manufacturing equipment, costing between 3 to 5 billion yen.

However, once a method to manufacture chips is established, mass production will become possible, so the unit price per chip is expected to drop. New companies that design, manufacture, or sell chips may appear.

Even so, the other components will still cost money. Currently, the most expensive component, other than the quantum bits, is the control unit, which costs about 200 to 400 million yen. Refrigeration systems, many of which are made by overseas companies, cost 120 to 200 million yen per unit. Other devices, including the power source and cables, total 100 to 150 million yen.

That means it takes at least about 500 million yen to make a quantum computer, disregarding the cost of the chips.

“Most of the components used in quantum computers are now general products,” notes Negoro. “If a component exclusively made for quantum computers becomes available, we can improve performance, downsize and reduce costs.”

iPhones, the globally ubiquitous device, are filled with Japan-made parts. While Japan is currently falling behind in the development of quantum computers, it could still emerge as a winner in the components business.

(Originally written in Japanese by Hiroyuki Oya, translated into English by Erklaren Inc., and edited by Connor Cislo)