Originally published in Japanese on Nov. 21, 2022

Hidden explanation

In early November, U.S. consumer price index (CPI) data came in under expectations, leading to a decline in the yield on U.S. treasuries and a sharp drop in the dollar. At one point the dollar-yen exchange rate dropped below 140 yen per dollar.

The CPI’s downward swing is good news, but the 7.7% year-on-year increase is still far from the Federal Reserve’s price stability target. The Fed will likely try to dampen the mood of optimism by sharing some hawkish information.

The Fed’s next rate hike is expected to shrink to 0.5% from 0.75%, but will there be a major reversal in dollar-yen trends simply because the interest rate differential between the U.S. and Japan is no longer “widening” but “slowly widening?” Would it make a difference even if such a reversal did happen?

Even if the yen were to regain half of the total value it has depreciated this year (38.47 yen), it would still be about 130 yen to the dollar. This would not have a significant impact on the image of “cheap Japan.” The more one ponders why the yen depreciated so much in 2022, rather than just celebrating or lamenting short-term market trends, the more difficult it seems to be to explain the phenomenon through only interest rate differentials.

While I will avoid the details in this column, here is one example: There is a great deal of discussion in the stock market focusing on the highs and lows of real interest rates. In terms of real interest rates, Japan has higher rates than the U.S. But the yen has nonetheless weakened by just under 40 yen this year because of interest rates alone? The idea strains credulity.

So what factors other than interest rates are responsible for the yen's depreciation?

Structural changes

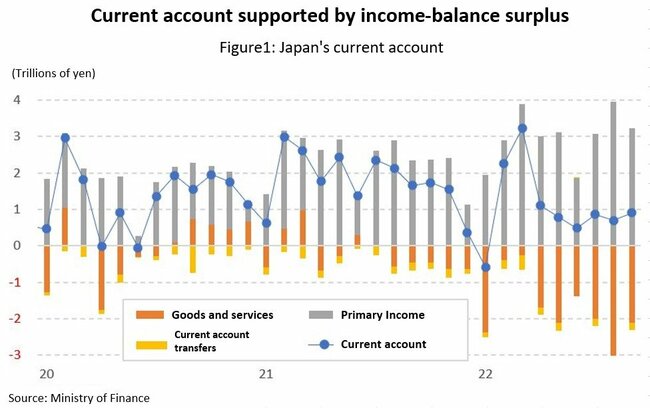

It is necessary to look at changes in supply and demand fundamentals. On Nov. 9, the Ministry of Finance released preliminary balance of payments data for the first half of fiscal 2022 (April to September). It showed a current-account surplus of 4.8 trillion yen ($35.3 billion at current exchange rates), down 60% compared to the same period last year.

However, this is not the smallest current-account surplus on record; in the first half of 2014, Japan had a surplus of just 2.8 trillion yen. As will be discussed, the fact that the country was able to maintain a surplus in the face of such strong headwinds gives the impression that it “fought the good fight.”

Weighing on the surplus, of course, is Japan’s 9.2-trillion-yen trade deficit, the largest on record (both exports and imports are at record highs, but the growth in imports has been particularly significant).

At the same time, the primary-income surplus was 18.2 trillion yen, also a record high, due in part to the weaker yen. This has ensured that the current account stays in surplus. At 3.2 trillion yen, the services deficit was huge, but it will be important to watch the degree to which this shrinks now that the ban on inbound travel to Japan has been lifted.

Although Japan has avoided falling into a current-account deficit, it is still on the whole a “country prone to outflows of foreign currency.” It is necessary to bear this in mind, regardless of short-term trends.

That is why I believe there is room for the dollar-yen market to slowly but surely return to its previous levels. In Japan, trends in the current account’s trade balance and outward foreign direct investment in the financial account (the counterpart of the current account) have changed significantly since around 2012.

In this regard, the idea of the primary balance (the sum of the current account balance and the former long-term capital account balance; this word is usually defined as government revenue minus spending other than interest payments, but it is not used as such in this context) as a traditional measure of the change in the balance of a country's external assets and liabilities is noteworthy. If net inflows continue in the primary balance, which shows stable capital flows, net external assets are likely to increase, and if net outflows continue, external net debt is likely to rise.

In a time when there was less international capital movement, and it was more difficult to distinguish between long-term and short-term capital, the primary balance was a hugely important number that greatly affected the creditworthiness of a country’s currency.

However, now that international capital flows more freely if a country’s currency continues to be sold according to the expectations of the foreign exchange market, the country may face greater difficulty in making external payments, even if its primary balance is healthy.

Therefore, the significance of the primary balance has faded over time, and it is questionable how much it should be discussed. When considering the problem of the ability to settle external payments, however, if trends in the primary balance are changing, it is worth noting as a structural change that the relevant country cannot ignore.

‘Last card’

I, therefore, consider the total of the current-account balance and net direct investment (outward direct investment minus inward direct investment) to be the primary balance, and the trends of this figure are worth watching. The net inflows that had continued until around 2012 are now facing intermittent net outflows.

For example, the average monthly primary balance for the 10-year period from January 2002 to December 2011 was 953 billion yen, while the average for the 10 years covering January 2012 to December 2021 was minus 17.4 billion yen, a net outflow (roughly balanced).

Incidentally, that figure for only the pandemic phase (January 2020 to September 2022) was 172.5 billion yen per month. In any case, the situation has changed considerably in the past 20 years. One cannot deny the possibility that one reason why Japan has not experienced panic over yen appreciation since around 2012 is the transformation of its primary balance.

The trend in the primary balance can be described as an outflow of direct investment — in other words, Japanese companies acquiring foreign businesses. This is relatively well known.

The yen’s depreciation frenzy in the spring of this year was likely due to the fact that previously existing changes in the structure of the currency’s supply and demand were highlighted amid rising resource prices. Combined with the Japanese economy’s sluggish growth and negative interest rates, markets felt they could safely sell yen.

One should note that the market changes were not continuous, but the groundwork (supply-demand environment) for it to become continuous had been prepared. At any given time, exchange rates are prone to overshooting.

While downbeat stories about Japan’s current-account balance draw attention, there is room for optimism. For the first half of fiscal 2022, it is significant that the country was able to maintain a current-account surplus despite deteriorating economic conditions overseas, rising resource prices, and the unprecedented depreciation of the yen.

As long as the current-account surplus continues, there is little likelihood of a fundamental shakeup in the structure of government debt. The odds are therefore high that the low prices and interest rates will enjoy some stability. Of course, structural reforms (symbolically, employment, regulatory and other reforms) are needed to increase wages while the current framework allows, but as usual, progress in this area has been slow.

The biggest problem facing Japan’s politics and economy is a lack of urgency, but that is a separate discussion. One takeaway, perhaps, from the current structure is that we now know that Japan’s current-account surplus is quite robust.

However, “secure current-account surpluses” is not synonymous with “supply and demand in the yen market are solid.” Certainly, continued surpluses are welcome, as a drop into a current-account deficit would likely lead to greater yen selling in the intuitive foreign-exchange market.

However, the primary-income surplus is recorded as a “surplus” when the foreign currency is earned, but only a small percentage of that foreign currency is estimated to return to Japan. This is not very reliable as a flow leading to yen buying.

Given the relative scarcity of people, goods, and money in the Japanese economy, Japan’s “last card” may be steps to bring back corporate profits retained overseas and interest and dividends reinvested in overseas securities.

I have long held that one possibility would be tax cuts to promote repatriation (i.e., bringing funds overseas back to Japan) as a solution, but considering given the Kishida administration's desire to raise taxes, the likelihood of such a policy appears low.

(Originally written in Japanese by Daisuke Karakama, translated and edited by Connor Cislo)

Daisuke Karakama is Chief market economist at Mizuho Bank. After joining the Japan External Trade Organization (JETRO), he was seconded to the Japan Center for Economic Research and the Directorate-General for Economic and Financial Affairs of the European Commission in Belgium. He joined Mizuho Corporate Bank (now Mizuho Bank) in October 2008. During his time at the European Commission, he was the only Japanese economist to work on preparing the EU economic outlook. The views expressed here are his own.