Originally published in Japanese on Jul. 4, 2022

A new postmodern cycle

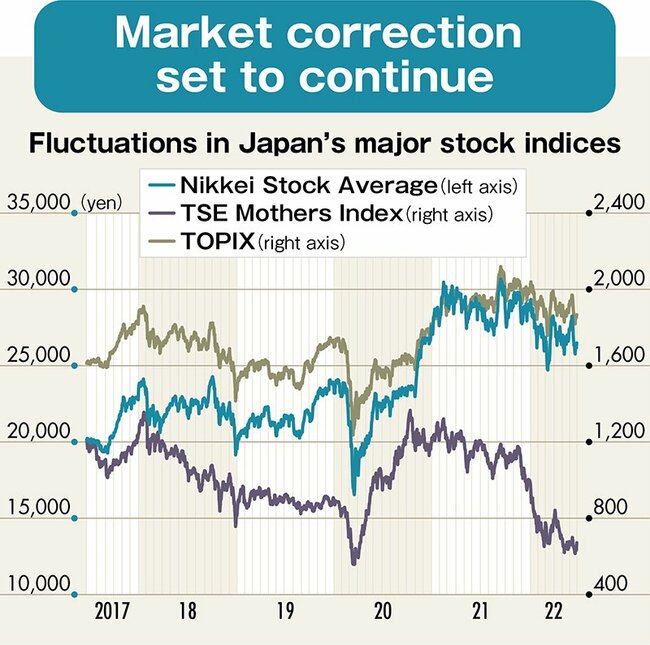

From the global financial crisis in 2009 to the height of the COVID pandemic in 2021, economies around the world were characterized by low prices, low interest rates, and monetary easing from central banks. In markets, money concentrated in growth stocks, such as the tech sector in the U.S., leading to bubble-like phenomena in some areas.

Investors focused on growth expectations; top-line growth, that is. Under disinflation, during which commodity prices generally stayed flat, only a limited number of companies could significantly increase their top line. This helped them stand out from the rest of the pack.

As markets have begun to look beyond the pandemic, however, things are changing. With interest rates rising and inflation picking up, companies’ ability to secure actual profits is becoming more important than expectations for their growth. This is also reflected in stock prices.

GS assumes the yield on the 10-year U.S. treasury, which significantly impacts the direction of the global economy and market trends, will be about 3% in the coming five years, higher than it has been over the past decade. In these conditions, stock prices will not rise as they did before, and price volatility will tend to increase.

Kazunori Tatebe, the Japanese stock strategist at GS Japan, notes that “simple things, like whether a stock is a growth stock or a value stock, or the country or region where the company is doing business, are becoming less important.” What will investors look to next?

Tatebe believes the next market cycle will be focused on “whether a company can achieve growth while fulfilling the needs of society.” This leads directly to sustainable profitability and will be a key point of scrutiny among investors.

Among these social needs, there are a few important keywords that market participants will watch for while planning stock investments.

Finding the keys

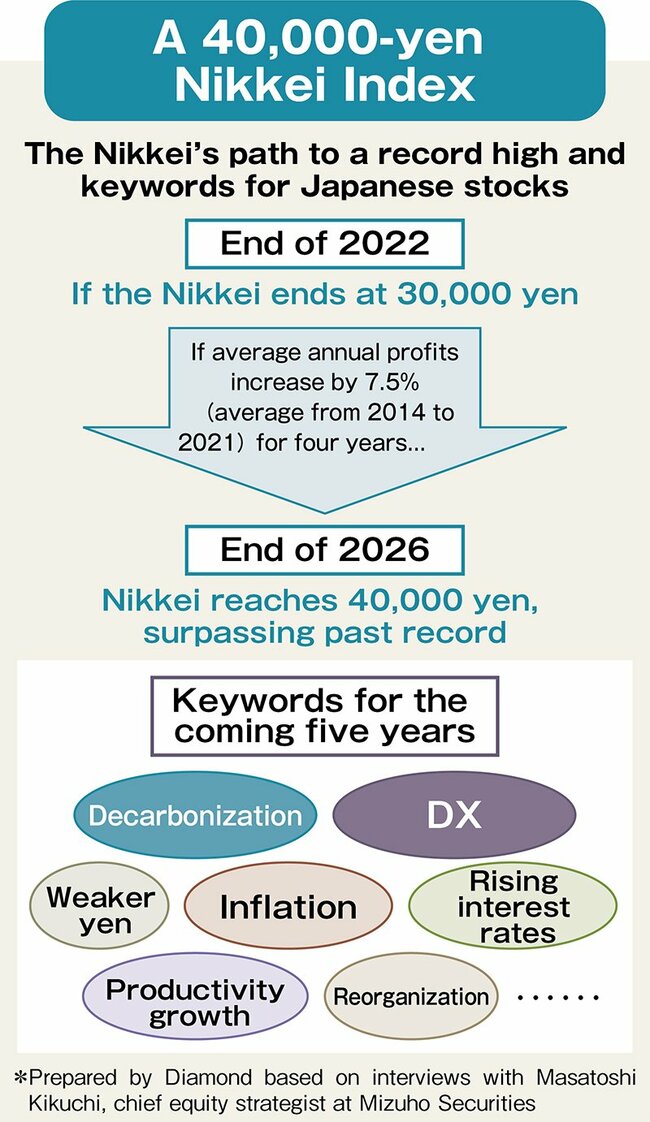

Even before the pandemic, “decarbonization” and “digital transformation (DX)” had been two of the most important buzzwords in the market. In Japan, with its shrinking and aging population, “productivity growth” and the “reorganization” of the industry will also be major themes in stocks. Moreover, markets everywhere are dealing with growing “inflation,” which has, in turn, prompted “rising interest rates” and a “weaker yen.”

Based on these trends, Masatoshi Kikuchi, chief equity strategist at Mizuho Securities, said he would not be surprised if the Nikkei Index tops 40,000 yen in 2026.

Assuming the index ends 2022 at 30,000, companies would need to achieve annual profit growth of 7.5% (the average annual rate from 2014 to 2021) for the Nikkei to reach 40,000 by 2026. That would put it past its previous record of 38,915 at the end of 1989.

The Japanese economy is still suffering from sluggish growth, but current trends in Japanese stocks are becoming disconnected from the domestic growth rate. At this point, many Japanese companies have gone global and steadily strengthened their earnings potential. Kikuchi said that the decoupling between Japan's economy and corporate earnings would continue to advance over the next few years.

However, even if the Nikkei reaches 40,000 yen, that is still only about 1.5 times larger than the current level. Many companies, known in the markets as “ten-baggers,” are currently seeing dramatic increases in their stock prices.

That means that although the average level of the Japanese stock market may increase, companies will inevitably become polarized in terms of their performance and stock prices. Considering the coming new market cycle envisaged by GS, in which companies with sustainable profits will excel, investors will need to be even more careful about sorting the wheat from the chaff.

(Originally written in Japanese by Kohei Takeda, translated into English by Erklaren, Inc. and edited by Connor Cislo)